Great Info About How To Avoid Predatory Lending

1 demand adequate disclosures.

How to avoid predatory lending. Becoming more financially literate helps borrowers spot red flags and avoid questionable lenders. [1] for example, you should receive a loan estimate after you apply for a loan. Legitimate lenders should fully disclose the true costs of a loan.

If you've experienced lending discrimination in the past,. Obtain loan quotes from multiple lenders to compare rates, fees, and terms, ensuring you choose the most favorable option. They should also explain any risks inherent in the loan.

6 tips to avoid a predatory lender written by sarah sharkey jul 11, 2023, 11:44 am pdt predatory lenders can ambush you when you least expect it. Stay informed about lending practices, interest rates, and loan terms to recognize and avoid predatory offers. Shop around for your loan before you sign on the dotted line.

Inadequate or false disclosure the lender hides or misrepresents the true costs, risks and/or appropriateness of a loan’s terms, or the lender changes the loan terms after the initial offer. How to avoid predatory lending it’s not always easy to spot predatory lending practices, so what are some steps you can take to protect yourself from predatory lenders? A patchwork of laws has been put in.

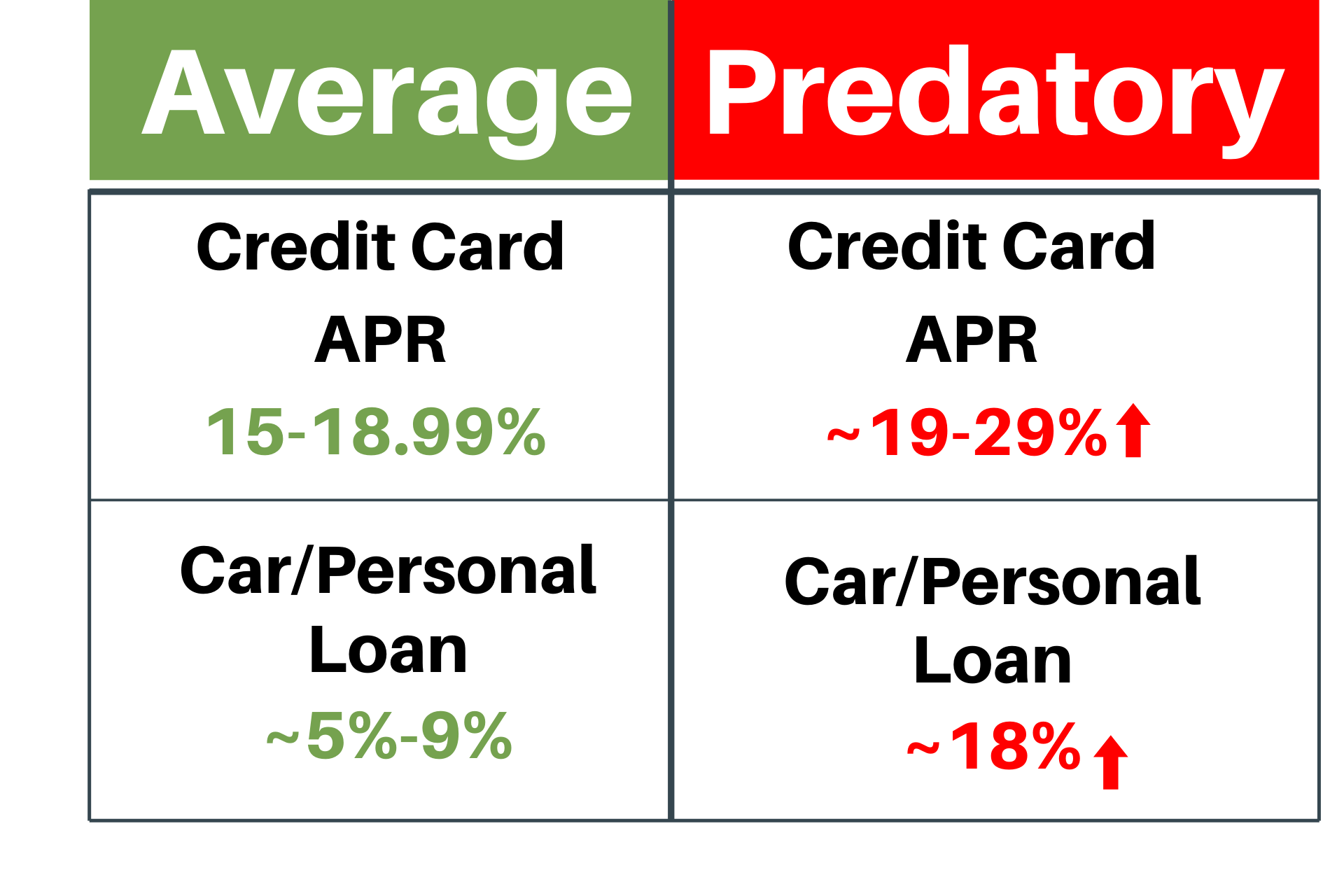

For instance, a lender might suddenly jack up the interest rate to unaffordable levels months or even years into your loan. How to avoid predatory lending educate yourself. When a lender promises you one type of loan but gives you a different one, this is called a bait and switch.

Shop around for loans before committing: Zocha_k/getty images our experts answer. Personal loans loans money home what is predatory lending?