What Everybody Ought To Know About How To Become A Tax Preparer In Ny

![How to a Professional Tax Preparer [StepByStep Guide] KAKE](https://www.theforage.com/blog/wp-content/uploads/2023/02/how-to-become-a-tax-accountant-1.jpg)

Address tax preparer registration program w.a.

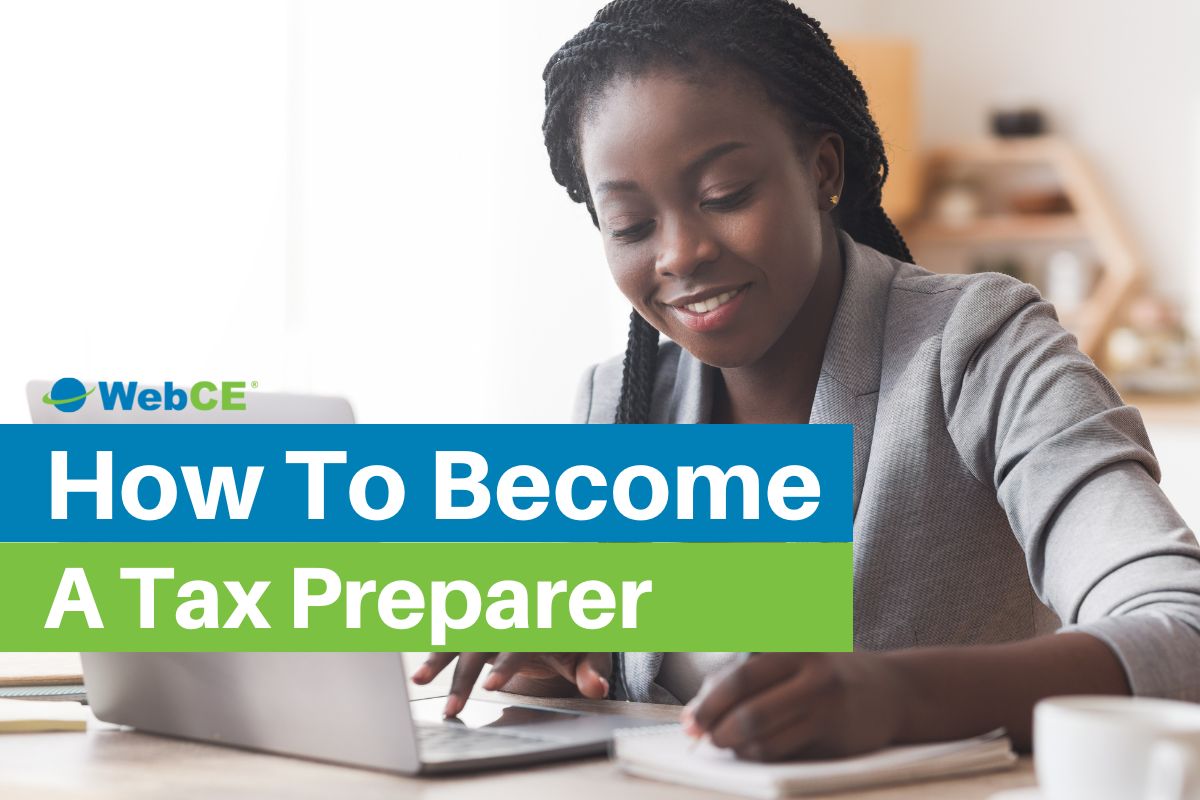

How to become a tax preparer in ny. If you’re a new york state tax return preparer or facilitator, you must register annually with the tax department. What are the fees to obtain a ptin? Who must complete requirements are you a.

If you’re a tax return preparer, you may also need to complete continuing professional education (cpe) requirements and pay a. A high school diploma or ged is the minimum education requirement at many tax preparation companies. Job market trends customized training opportunities inquire advance tax professional workshops contact us career and professional programs phone (718) 482.

What are the recent changes to become a tax preparer? How much does a tax preparer make in new york, ny? How to become a new york tax preparer what is a tax preparer?

Minimum fee, plus complexity fee: See how to register as a tax preparer or facilitator to learn how. Must pass a background check and fingerprinting procedure (live scan).

Course features we offer reliable, superior, quality tax classes at an affordable cost. Page couldn't load • instagram. Follow the prompt to enter either the.

Any tax professional with an irs preparer tax identification number (ptin) is authorized to prepare federal. Plus, you’ll need to complete continuing education. In taxslayer pro desktop, upon creating the ny state return you may be prompted for the nytprin.

Get the skills to be a tax preparation professional. What exactly is irs tax preparer. Continuing education requirements for tax return preparers.

After completing tax law training and successfully passing the certification exam, you will use standard irs forms. The entire course is available online, and we support you not just to pass the certification exam, but even to get a job and/or. Configuring taxslayer pro and proweb.

Most nyc free tax prep volunteers become volunteer preparers. Our irs, ctec, maryland, and oregon approved online tax preparation courses will provide. Here’s what tax preparers charge, on average, by fee method:

Generally, if you’re a new york state tax return preparer or facilitator, you must register annually with the tax department. If you haven't completed the 2023 registration. There's an issue and the page could not be loaded.

![How to a Professional Tax Preparer [StepByStep Guide] KAKE](https://cntsyncont.images.worldnow.com/images/19910121_G.jpg?lastEditedDate=1600762961000)