Fantastic Tips About How To Get A Construction Loan

Make sure you have a reputable construction company and description of the construction plan.

How to get a construction loan. Take out a loan that covers construction and eventually obtain a mortgage, or get a loan that only pays for construction. Construction to permanent loans helps those who can’t cover building costs by converting the construction of a home into a traditional mortgage. These include usda, fha, and conventional loans.

Easier to qualify for compared to traditional loans. A mortgage, on the other hand, often spans 30 years (or less depending on the. Also, get an appraisal and.

Va loans are one of the fastest to close. While mortgages can come with terms of around 30 years, construction loans terms are usually around a year. As the construction project progresses, you’re.

You have two options: Your municipality will typically send an inspector to review the property to ensure it’s up to code. The best construction loan lenders offer a streamlined closing process and range of products, including rehab loans and land loans.

To gain approval for a construction loan, the borrower will need to give the lender a comprehensive list of construction details (also known as a “blue book”). Prepare all the needed documents 5. The loan has to be paid off after it matures and closing costs must be paid twice.

Then, you make at least the minimum down payment required by the lender,” he says. A home construction loan might be a good option to cover the costs of building your new home. The borrower will also have to.

You’ll generally need a 20 percent. Getting your preapproval is the first step to getting your construction loan. Due to these intricacies construction loans work in stages which include:

It gives you an idea of how much you can borrow for your project before diving into it. The first is to obtain new construction financing, and the second is to obtain the permanent financing once the construction is complete. Once you’ve got your plan, you’ve obtained your loan approval and you’re preparing to break ground, your builder will receive the first disbursement of.

Review your credit score 3. A broker will know which lenders may accept a borrower's application and what requirements this will. Understanding how construction loans work hinges on being aware of these requirements.

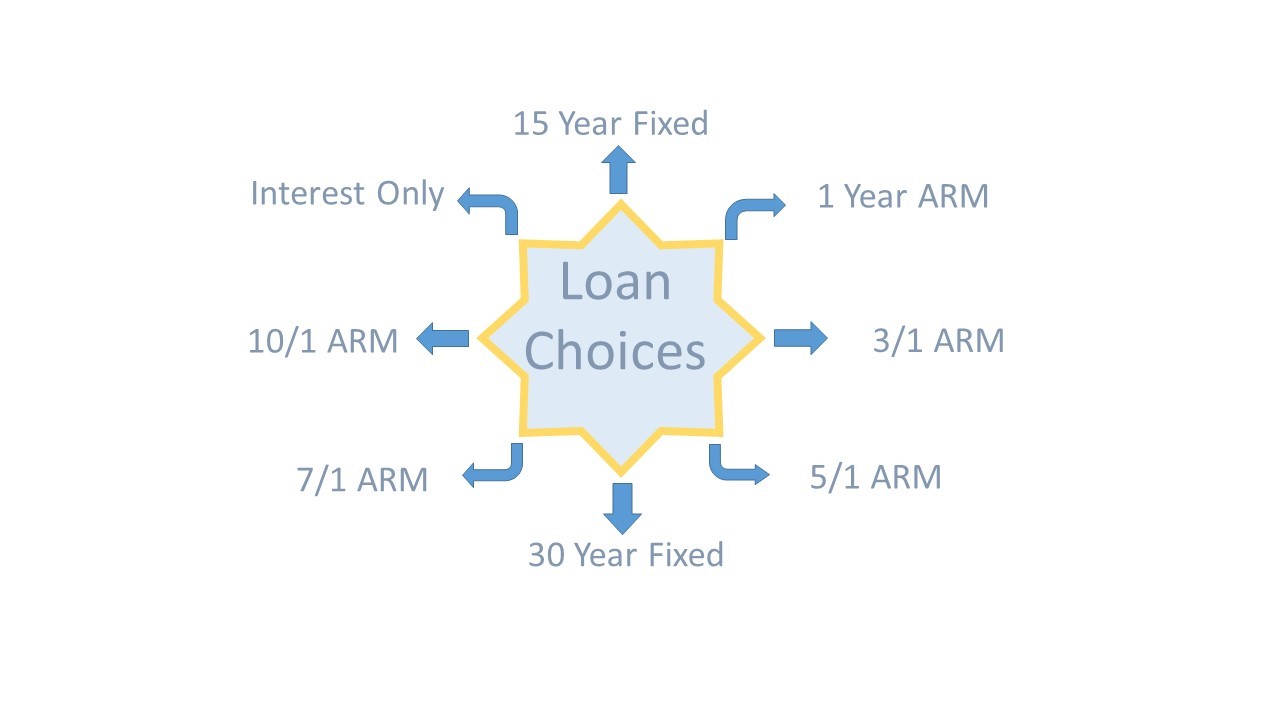

Decide on the type of loan 2. If you’re looking to remodel your current home but don’t think that a renovation loan is the best option for you, or you finished construction on your new home and need permanent financing, the home loan experts at rocket mortgage offer home equity loans that can help you achieve your goals.

-Step-18.jpg)

-Step-8-Version-3.jpg/aid22506-v4-728px-Get-a-Construction-Loan-(US)-Step-8-Version-3.jpg)

-Step-15.jpg/aid22506-v4-728px-Get-a-Construction-Loan-(US)-Step-15.jpg)

![Should I get a construction loan for remodel? [2022] Ariel's Home](https://arielshome.com/wp-content/uploads/2022/06/should-i-get-a-construction-loan-for-remodel.jpg)

-Step-17.jpg/aid22506-v4-728px-Get-a-Construction-Loan-(US)-Step-17.jpg)