Amazing Info About How To Check Efile Status

Single, head of household, married filing jointly, married filing separately or.

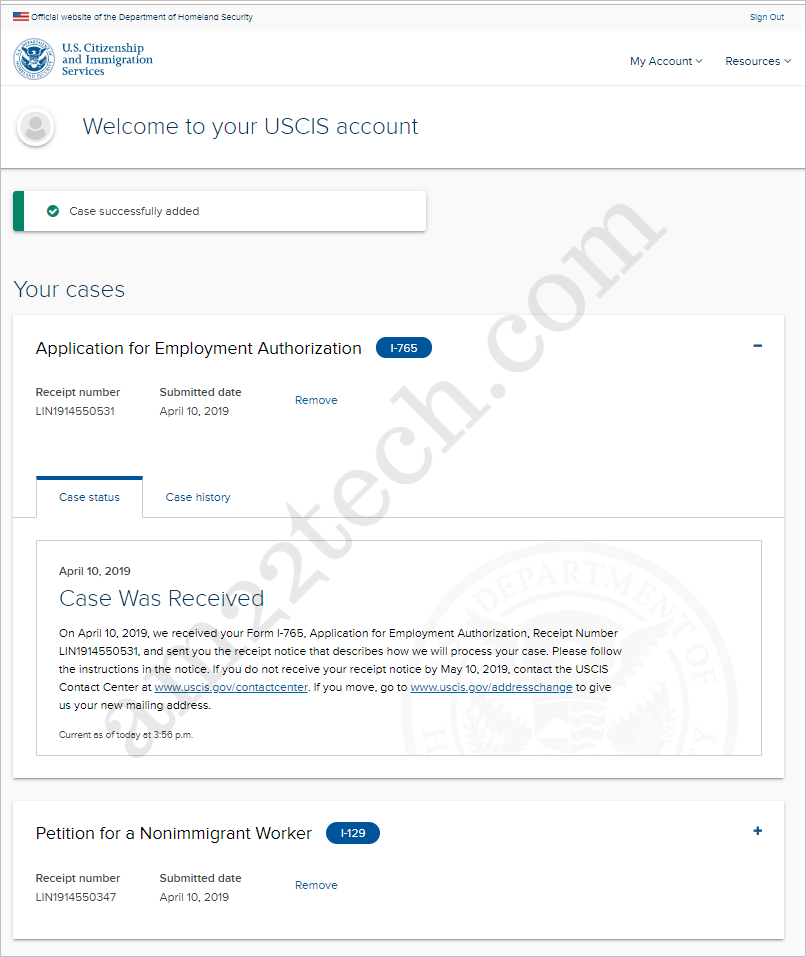

How to check efile status. Enter your details to easily track your return's progress. Monitor the progress of your federal income tax return. Your filing status may change after a major life event like getting married.

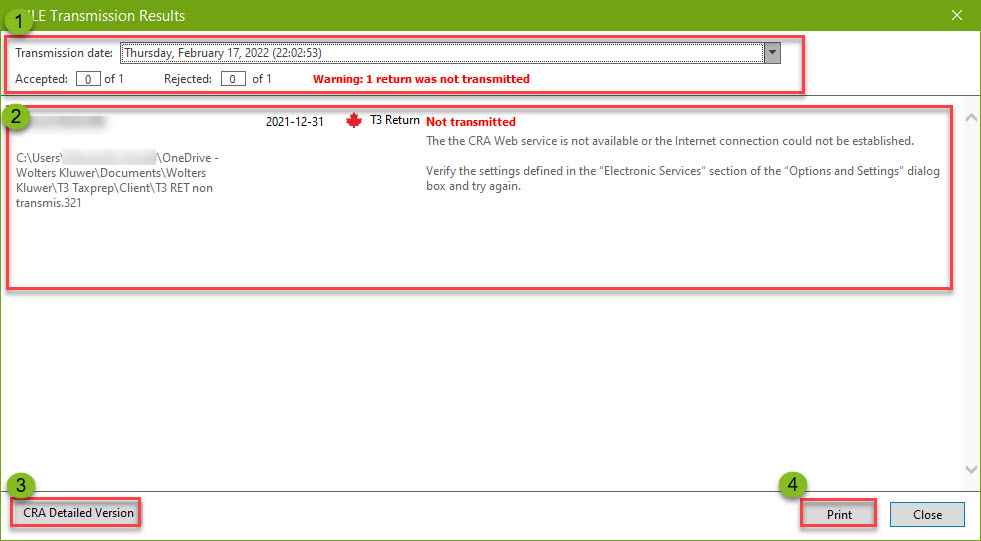

(app / online) sign in to turbotax. If you've submitted your return, you'll see a pending, rejected, or accepted status. Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series.

If you like to wait till the last second, the deadline to file federal tax returns for most taxpayers is monday, april 15, 2024. Use this tool to check your refund. Solved • by turbotax • duration :33 • 775 • updated 1 month ago related information:.

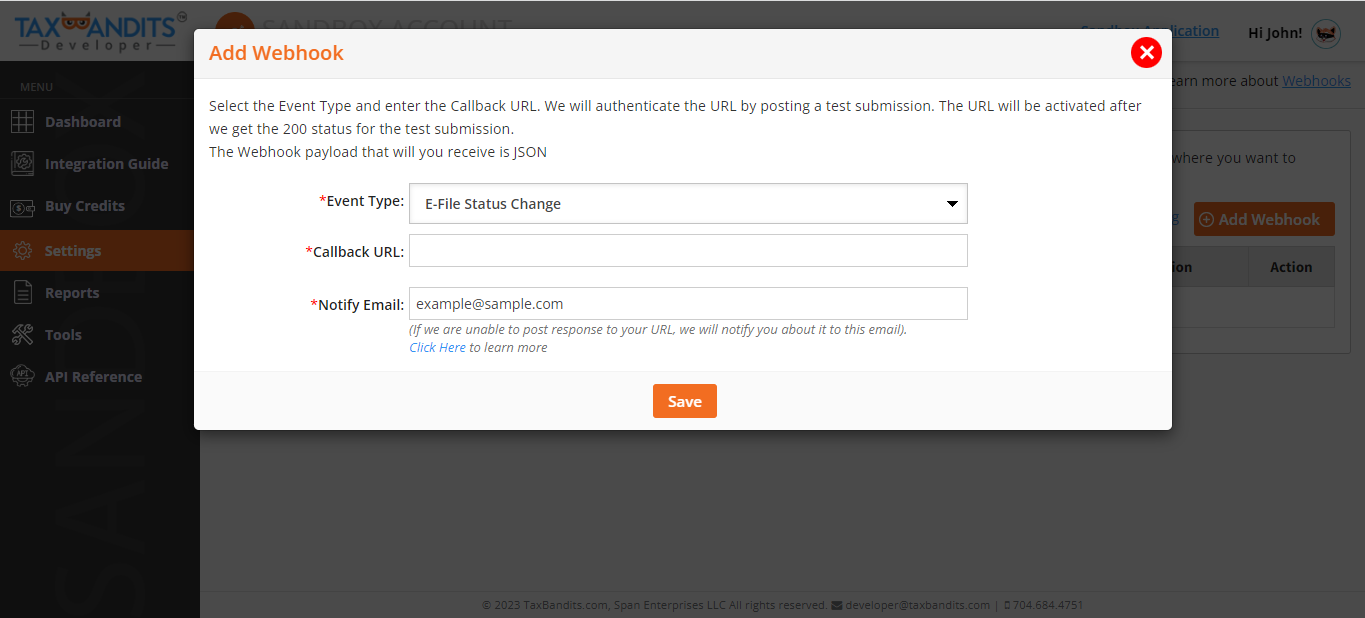

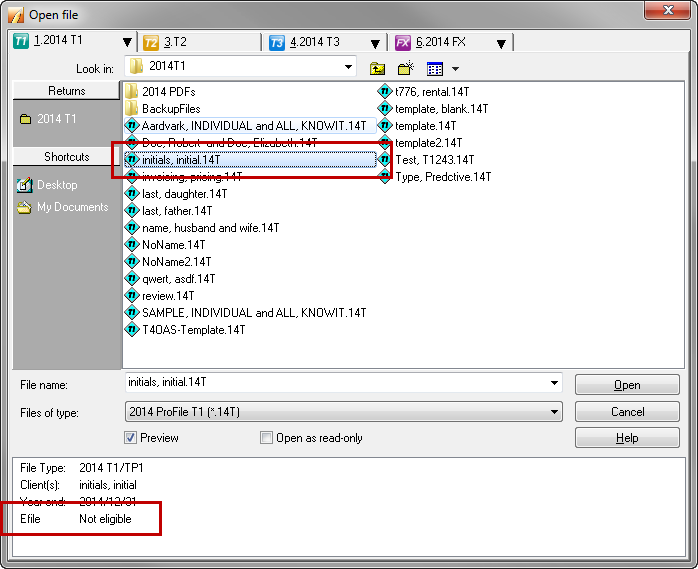

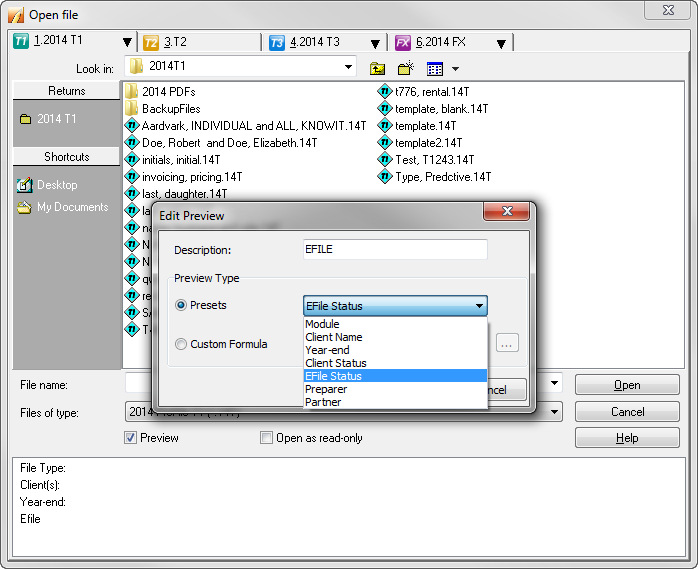

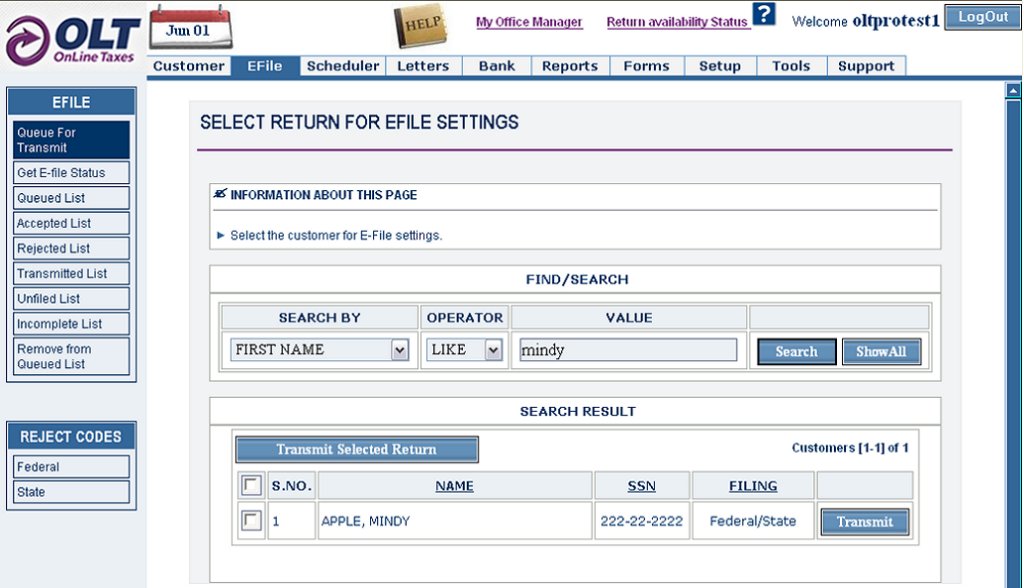

Click the submit button to retrieve acknowledgements for your client from the specified date. Call the irs. Your refund status will appear.

The most convenient way to check on a tax refund is by using the where's my refund? Social security number and birthdate filing status: Taxpayers living in maine or massachusetts.

Can we file our return electronically? Each year, you should choose the filing status that accurately matches your circumstances. I filed electronically and my tax.

Wait times to speak to a representative may be long. To check your refund status, you will need your social security number or itin, your filing status and the exact refund amount you are expecting. If you haven't submitted your return yet, you'll see let's keep working on your taxes!

Enter the customer number your client's tax identifying number in ssn/ein. My spouse and i will be filing an original joint form 1040 series tax return. When you call, be ready to give your: