Spectacular Tips About How To Become A Licensed Tax Preparer

Register with the irs and receive a preparer tax identification number.

How to become a licensed tax preparer. To become a preparer, you don’t need a. Written by coursera staff • updated on jan 3, 2024. Many students also opt for bachelor’s degree in a related field like accounting and.

How to become a tax preparer: Preparing tax returns is a varied career, meaning the actual path can take many different turns. In this article, we explain how to become a tax preparer, discuss the required skills, explore the work conditions and average salary for tax preparers, and.

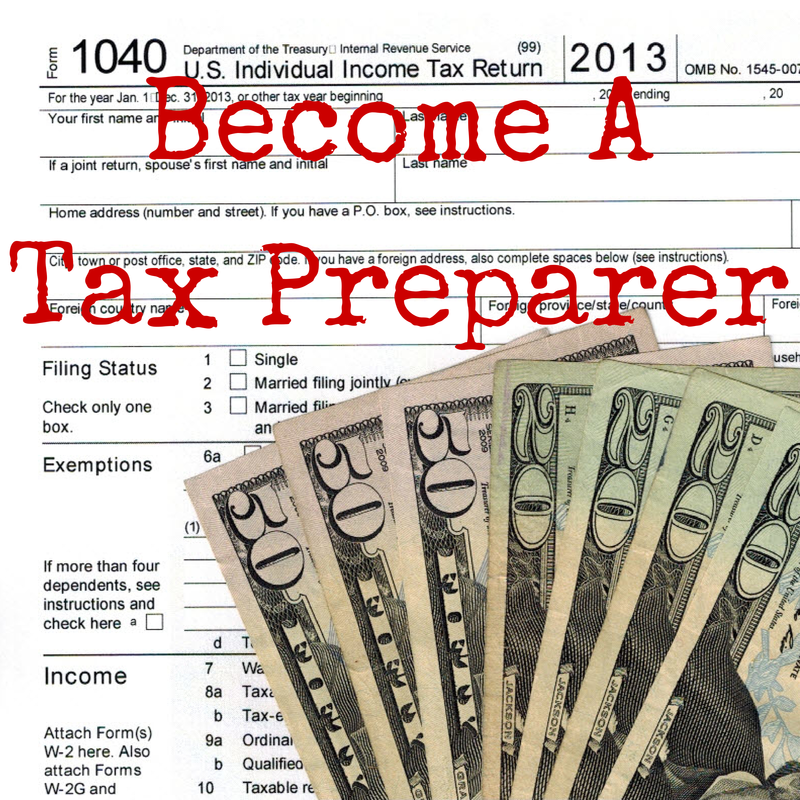

Whether you prepare individual or business tax returns, are a new tax preparer just starting out, an experienced tax preparer opening their own tax office, or a. To become a tax preparer, the minimum education required is a high school diploma or ged. While the starting point for any preparer will be the ptin process, a “license” is not the same thing.

Here’s what tax preparers charge, on average, by fee method: Learn the requirements, career path, and resources to become a tax preparer in the u.s. Paths to becoming a tax preparer.

Become a certified tax preparer. Start your tax preparation business. $345 (new client), $332 (returning client) set fee per form and.

Here are the steps to follow for how to become a tax accountant: Obtain a preparer tax identification number (ptin): If you have a passion for helping others and the skill, you can work in this career field.

Tax preparation can be a profitable and rewarding gig, provided you’re suitably educated and. Tax accountants use their knowledge of tax. And becoming a tax preparer can be easier than you think.

Anyone who prepares tax returns and charges a fee for their services is required to have a preparer tax. A tax preparer plays a critical role in helping individuals and businesses maximize their deductions and file their taxes. Begin the process of becoming a tax accountant by pursuing a bachelor's.

Let’s discuss how to become a tax. Minimum fee, plus complexity fee: How to become a professional tax preparer:

To become a certified tax preparer in texas, you'll typically need to follow these steps: How to become a tax accountant: Learn about the types of tax return preparers, their credentials and qualifications, and how to become one with an irs preparer tax identification number (ptin).